#Understanding the Token Economy in NFTs

Explore tagged Tumblr posts

Text

The Fundamentals of NFT Token Economics

Introduction

Token Economics plays a significant role in non-fungible tokens (NFTs). The present article will act as a beginner's guide toward the token economy in NFTs, with a deep discussion and elaboration of fundamental concepts and mechanisms driving value and utility in this new and innovative digital ecosystem. Because NFTs continue to change how we see ownership, creativity, and investment in digital assets, understanding the principles underpinning their economic framework becomes vital.

What is Token Economics in NFTs?

Toke Economics represents the economic principles and models guiding the creation, distribution, and utility of tokens, such as NFTs. As opposed to traditional assets, NFTs are unique, verifiable digital assets on a blockchain. In contrast to other assets, value is determined not just by content but also by tokenomics, which defines the mechanisms governing supply, demand, scarcity, and functionality.

The structure of tokenomics comprises elements like the supply, scarcity, utility of tokens, reward mechanisms, and governance in the NFT ecosystem. Understanding these can explain why some NFTs acquire immense value, but others go relatively unnoticed.

Read More: Understanding the Token Economy in NFTs

Functionality of NFTs

1.Supply and Scarcity

Supply and scarcity are interlinked concepts in the NFT economy. Supply refers to the total number of tokens available, whereas scarcity focuses on the limitation of such tokens. Most NFT projects consciously restrict supply to create scarcity. Here are a few examples:

Limited Editions: Capping the number of tokens available for a specific item will make the creator generate scarcity and thereby increase the desirability of the NFT.

Digital art is one-of-a-kind: such things are naturally lower and, thus command higher prices because they never existed before.

The element of scarcity triggers the sort of collector behavior such as FOMO. A situation in which scarce NFT often commands higher trading volumes in comparison to others in similar market trends.

2.Value Creation

Value in the NFT space is built upon the principles of scarcity, demand, and perception. Rarity makes an NFT extremely exclusive, allowing collectors and investors to pay more money for it. Speculative markets add more to the dynamic, whereby a buyer purchases an NFT in the hope that it will one day sell for more.

3.Utility Functionality

Utility refers to the practical application or benefit of owning an NFT. NFTs can be more than collectibles; they serve different purposes, which heightens their appeal and value.

Exclusive Access and Privileges

NFTs often give owners a right or privilege that is special to them, such as the following:

Access to Digital Content: Owners can open exclusive digital content, including songs, videos, or in-game items.

Membership and Events: Some NFTs are the pass to exclusive events, clubs, or virtual spaces.

Voting Rights: Some decentralized platforms may grant governance rights upon holding an NFT, which entitles their holders to vote on project decisions.

4.Economic Models and Community Engagement

Most NFT projects rely on innovative economic models and significant community engagement to succeed.

Royalties and Revenue Streams

Smart contracts embedded in NFTs guarantee that the creators earn royalties from each resale. This continuous revenue model will encourage the creators to make quality work and align their interests with the market performance of the NFT.

Reward Mechanisms

NFT ecosystems often include rewards to encourage user participation:

Staking: NFT holders can receive rewards by locking their assets in staking pools.

Participation Incentives: Participation in activities such as community votes or event participation can result in exclusive NFTs or tokens.

Community-Centric Engagement

Community is the lifeblood of NFT projects. Tokenomics often encourages collective growth through:

Collaboration through fractional ownership.

Loyalty through airdrops or exclusive perks for early adopters.

Governance rights, which allow users to have a say in the direction of the project.

Why is token economics important?

Token economics is playing a crucial role in the larger NFT ecosystem as it impacts its stability, growth, and innovation. The often-discussed topics include supply, scarcity, value, utility, and community engagement, but structural and functional dynamics define how NFTs interact with technological, regulatory, and financial frameworks.

One of the most important areas where token economics affects NFTs is scalability. As the NFT market grows, networks that host these tokens are becoming congested and experiencing high fees for transactions. Good tokenomics integrates solutions such as layer-2 scaling, alternative blockchains, and sharding to ensure smooth operations within the ecosystem. For example, moving NFTs to blockchains with lower transaction costs or developing solutions for batching transactions makes the ecosystem more accessible and sustainable, especially to smaller investors.

Sustainability is another key aspect. The production and trade of NFTs have sparked much debate over energy usage, especially in proof-of-work blockchains. Token economics addresses these concerns through the incentives of environmentally friendly practices, such as the shift to proof-of-stake or carbon offset programs. These measures bring technological advancement and environmental responsibility in tandem, opening the way to more widespread adoption.

Regulatory frameworks also play a significant role in token economics in NFTs. As the industry matures, governments and institutions are looking into royalties, revenue-sharing, and taxation of digital assets. A good tokenomics model should be proactive in adapting to these regulatory challenges, ensuring compliance while maintaining decentralization. This adaptability is important for building trust and attracting institutional investors into the NFT market.

Other aspects of tokenomics include innovation and technological integrations beyond the simple application of concepts. NFTs often interact with smart contracts, which enable functionalities such as dynamic pricing, conditional access, and automated royalties. These mechanics are flexible enough for projects to explore new use cases, such as combining NFTs with DeFi or integrating them into a physical good or service. Tokenomics provides the basis for these integrations, making it feasible and beneficial for the parties involved.

Finally, token economics makes the market dynamics and risk management more favorable. NFT markets often operate under speculation, creating volatility. Tokenomics may design systems that encourage long-term holding, discourage pump-and-dump schemes, and promote diversified investments. Mechanisms such as fractional ownership and liquidity pools expand participation in markets, making it possible for investors at all scales to meaningfully engage with NFTs.

In essence, token economics in NFTs goes beyond elementary factors and addresses issues such as scalability, sustainability, regulatory compliance, and market innovation. Its role is integral in shaping a robust and inclusive ecosystem that supports long-term growth and adoption. The careful nuances provide an understanding of the dynamic forces shaping this transformative potential.

Challenges and Future Developments

The token Economics has unlocked incredible potential in the NFT space, but challenges remain.

Scalability

A wave in the popularity of NFTs has emphasized the need for scalability on major blockchains. High transaction fees and network congestion can prevent participation, especially from the smaller investor base. Solutions to these issues are layer-2 scaling and alternative blockchains.

Market Volatility

The price of NFTs fluctuates wildly, not least due to speculative trading and market sentiment. Thus, creating sustainable Token Economics models that help to reduce the effects of volatility is necessary to encourage long-term adoption.

Regulatory Considerations

The NFT space resides in a regulatory gray area. Governments and institutions are starting to ask about the legality of certain Token economics practices, including royalties and revenue-sharing mechanisms. Thus, clarity about the regulatory frameworks will be paramount in achieving stability and compliance.

Sustainability

Energy consumption remains an issue of debate. Transitioning into more environmentally friendly mechanisms, such as proof-of-stake, may help to mitigate environmental concerns over NFT creation and trading.

Conclusion

To understand NFTs, it is essential to know about token economics. Scanning through supply, scarcity, value, utility, economic models, and community engagement can let the individual move through this new NFT landscape while being informed in their decisions, contributing to this transformative economy in the digital world.

The future of NFTs and their token economics is full of promise. As the ecosystem evolves, the point of intersection between creativity, technology, and economics will continue to redefine how we perceive and interact with digital assets.

Source

#non-fungible tokens#Understanding the Token Economy in NFTs#nft#nftart#nft tutorials#nftcommunity#digital nft

0 notes

Text

Bitcoin's role in the future of finance

In the ever-evolving landscape of finance, one digital currency has captured the world's attention like no other: Bitcoin. Since its inception in 2009, Bitcoin has transcended from being a mere experimental concept to a transformative force, challenging traditional financial systems and reshaping our perception of money. As we navigate through the complexities of the modern financial world, it's imperative to understand Bitcoin's role in shaping the future of finance.

Bitcoin's Rise to Prominence: Bitcoin's journey from obscurity to prominence has been nothing short of remarkable. Introduced by the pseudonymous Satoshi Nakamoto, Bitcoin was envisioned as a decentralized digital currency, free from the control of central authorities such as banks or governments. Its underlying technology, blockchain, revolutionized the way transactions are recorded and verified, offering transparency, security, and immutability.

Initially met with skepticism and skepticism, Bitcoin gradually gained traction among tech enthusiasts, libertarians, and early adopters seeking an alternative to traditional fiat currencies. As its utility and acceptance grew, Bitcoin's value soared, attracting mainstream attention and investment from institutional players and retail investors alike.

Bitcoin's Role in the Future of Finance: Now, as we stand on the precipice of a new era in finance, Bitcoin's significance cannot be overstated. Here's how Bitcoin is poised to shape the future of finance:

Decentralization and Financial Inclusion: At the heart of Bitcoin lies its decentralized nature, which empowers individuals to take control of their financial destinies. Unlike traditional banking systems, where intermediaries dictate transactions and impose fees, Bitcoin allows for peer-to-peer transactions without the need for intermediaries. This decentralization fosters financial inclusion by providing access to banking services for the unbanked and underbanked populations worldwide.

Hedge Against Inflation and Economic Uncertainty: In an era marked by economic volatility and uncertainty, Bitcoin offers a hedge against inflation and currency devaluation. With a finite supply of 21 million coins, Bitcoin is immune to the whims of central banks and government policies that often erode the value of fiat currencies. As central banks continue to print money to stimulate economies, Bitcoin's scarcity and deflationary nature make it an attractive store of value and a hedge against economic downturns.

Innovation in Financial Services: Bitcoin's underlying technology, blockchain, has paved the way for innovative financial services and applications. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) and smart contracts, Bitcoin's ecosystem continues to expand, offering new avenues for investment, lending, and asset management. These innovations have the potential to democratize finance, making it more accessible and inclusive for individuals worldwide.

Global Payments and Remittances: As a borderless digital currency, Bitcoin facilitates fast, low-cost cross-border payments and remittances. Unlike traditional banking systems, which are plagued by high fees and long processing times, Bitcoin enables instant transactions without the need for intermediaries. This has significant implications for global commerce, enabling businesses to streamline payments and expand their reach to new markets.

Institutional Adoption and Mainstream Acceptance: In recent years, we've witnessed a surge in institutional adoption of Bitcoin, with major corporations and financial institutions incorporating Bitcoin into their investment portfolios. This institutional endorsement not only lends credibility to Bitcoin but also paves the way for mainstream acceptance. As more businesses and individuals embrace Bitcoin, its role in the future of finance is poised to become even more pronounced.

Conclusion: In conclusion, Bitcoin's role in the future of finance is multifaceted and profound. From decentralization and financial inclusion to innovation and global payments, Bitcoin has the potential to reshape the way we perceive and interact with money. As we embrace the digital revolution, Bitcoin stands at the forefront, offering a glimpse into a future where financial empowerment and freedom reign supreme. As we embark on this journey, one thing is clear: Bitcoin is not just a digital currency; it's a catalyst for change, ushering in a new era of finance for generations to come.

How will Bitcoin be used in the future?

In the ever-evolving landscape of digital currencies, Bitcoin stands tall as a pioneer, offering a glimpse into the future of finance. But how will Bitcoin be used in the future? Let's delve into the possibilities and potential of this groundbreaking cryptocurrency.

Global Transactions and Remittances: Bitcoin's borderless nature makes it ideal for facilitating international transactions and remittances. As traditional banking systems struggle with high fees and lengthy processing times, Bitcoin offers a faster, more cost-effective alternative. In the future, we can expect to see Bitcoin used as a primary means of transferring value across borders, empowering individuals and businesses alike.

Store of Value: With its finite supply and decentralized nature, Bitcoin has emerged as a reliable store of value akin to digital gold. As economic uncertainty looms and traditional fiat currencies face inflationary pressures, Bitcoin offers a hedge against depreciation. In the future, we may witness a significant portion of wealth stored in Bitcoin, safeguarding against currency devaluation and economic downturns.

Mainstream Adoption: While Bitcoin has already gained widespread recognition, its adoption is poised to skyrocket in the future. As more merchants accept Bitcoin as a form of payment and financial institutions integrate it into their services, Bitcoin will become increasingly accessible to the masses. This mainstream adoption will fuel its use in everyday transactions, from purchasing goods and services to receiving salaries.

Financial Inclusion: Bitcoin has the potential to bridge the gap between the banked and unbanked populations, particularly in developing countries. individuals who have been excluded from the formal financial system, fostering greater financial inclusion and economic empowerment.

Smart Contracts and Decentralized Finance (DeFi): Bitcoin's underlying technology, blockchain, enables the creation of smart contracts and decentralized finance applications. In the future, we can expect to see Bitcoin utilized in a variety of DeFi platforms, offering innovative financial services such as lending, borrowing, and trading. These decentralized applications will revolutionize traditional financial systems, providing greater accessibility and transparency to users.

Hedging Against Geopolitical Risks: As geopolitical tensions rise and governments impose sanctions, Bitcoin provides a means of circumventing restrictions on capital flows. In the future, we may see individuals and businesses turn to Bitcoin as a hedge against geopolitical risks, preserving their wealth in a borderless and censorship-resistant asset.

Integration with Central Bank Digital Currencies (CBDCs): While Bitcoin operates independently of central banks, it may complement the emerging trend of central bank digital currencies (CBDCs). In the future, we could see interoperability between Bitcoin and CBDCs, facilitating seamless exchange between digital and traditional currencies.

In conclusion, the future of Bitcoin is filled with promise and potential. From facilitating global transactions to fostering financial inclusion, Bitcoin is poised to revolutionize the way we think about money. As we embrace this digital frontier, Bitcoin will continue to shape the future of finance, empowering individuals, businesses, and economies worldwide.

What is the future of long term Bitcoin?

In the ever-evolving realm of cryptocurrencies, Bitcoin stands as the pioneer, the trailblazer that ignited a digital revolution. From its inception in 2009 by the mysterious Satoshi Nakamoto to its current status as a trillion-dollar asset, Bitcoin has captured the imagination of investors, tech enthusiasts, and economists alike. But what does the future hold for long-term Bitcoin? Let's embark on a journey to unravel the mysteries and explore the potential trajectory of this digital gold.

As we gaze into the crystal ball of cryptocurrency, one thing becomes clear: Bitcoin's long-term future is intricately tied to its ability to adapt and overcome challenges. Like any revolutionary technology, Bitcoin has faced its fair share of hurdles, from scalability issues to regulatory scrutiny. Yet, with each obstacle, Bitcoin has emerged stronger, more resilient, and more ingrained in the fabric of our digital economy.

So, what can we expect from long-term Bitcoin? Let's delve into the key factors that will shape its future:

Adoption and Integration: The widespread adoption of Bitcoin as a mainstream asset class is perhaps the most crucial determinant of its long-term success. As more institutions, corporations, and individuals embrace Bitcoin as a store of value and hedge against traditional financial systems' uncertainties, its long-term viability strengthens. With the recent trend of institutional adoption and the emergence of Bitcoin-based financial products, such as ETFs, the path towards mainstream acceptance becomes clearer.

Technological Advancements: The underlying technology behind Bitcoin, the blockchain, continues to evolve at a rapid pace. From scalability solutions to privacy enhancements, ongoing developments in blockchain technology promise to address Bitcoin's current limitations and unlock new possibilities. Layer 2 solutions like the Lightning Network offer faster and cheaper transactions, making Bitcoin more practical for everyday use.

Regulatory Clarity: Regulatory uncertainty has been a lingering shadow over Bitcoin's journey. However, as governments worldwide grapple with the complexities of cryptocurrency regulation, clarity begins to emerge. Clear and balanced regulatory frameworks can provide legitimacy and stability to the Bitcoin market, paving the way for greater institutional involvement and investor confidence.

Market Dynamics: The dynamics of the cryptocurrency market play a pivotal role in shaping Bitcoin's long-term trajectory. Price volatility, market sentiment, and macroeconomic factors all influence Bitcoin's price movements. However, as Bitcoin matures and its market cap grows, it becomes less susceptible to manipulation and wild price swings, leading to a more stable long-term outlook.

Global Socioeconomic Trends: Bitcoin's future is intertwined with broader socioeconomic trends, such as the shift towards digitalization, the erosion of trust in traditional financial institutions, and the quest for financial sovereignty. As individuals seek alternative forms of money and value preservation, Bitcoin's role as a decentralized, censorship-resistant asset becomes increasingly relevant.

In conclusion, the future of long-term Bitcoin is a tale of resilience, innovation, and adaptation. While challenges remain, Bitcoin's journey from obscurity to ubiquity reflects its intrinsic value and disruptive potential. As we navigate the ever-changing landscape of cryptocurrency, one thing is certain: Bitcoin's legacy will endure, shaping the future of finance and technology for generations to come.

3 notes

·

View notes

Text

NFTs and Beyond: The Evolution of Digital Ownership at the Blockchain

In latest years, Non-Fungible Tokens (NFTs) have transformed the idea of digital ownership, marking a brand new era of blockchain innovation. NFTs are particular virtual property that constitute ownership or authenticity of particular gadgets or content material, verifiable at the blockchain. This article explores the evolution of NFTs and their effect on digital possession.

Definition of NFTs

NFTs are awesome digital belongings that certify ownership or authenticity of a specific item or content. Each NFT is precise and verifiable at the blockchain, making it best for representing digital collectibles, artwork, and other assets.

Overview of Blockchain Technology

Blockchain serves as the inspiration for NFTs, providing a decentralized and immutable ledger for recording transactions. It is a allotted database that continues a constantly growing listing of statistics, or blocks, connected collectively in a chronological chain. This ledger guarantees transparency, protection, and censorship resistance, allowing the creation and transfer of digital assets correctly.

The Rise of NFTs

NFTs trace their origins to early blockchain experiments like Colored Coins and Rare Pepes. However, it become the release of CryptoKitties in 2017 that brought NFTs into the mainstream. Since then, the NFT ecosystem has seen large boom, marked by way of milestones along with the introduction of standards like ERC-721 and ERC-1155 and top notch events like Beeple’s $sixty nine million sale of a virtual artwork.

Understanding the Hype Surrounding NFTs

The hype round NFTs may be attributed to their novelty, shortage, and ability for democratizing get admission to to virtual assets. NFTs have captured the creativeness of creators, creditors, and customers, imparting new avenues for monetization and ownership inside the virtual realm.

Understanding Digital Ownership

Traditional ownership relates to tangible property, at the same time as virtual possession pertains to intangible belongings saved in digital form, like cryptocurrencies and NFTs. Establishing virtual possession offers demanding situations because of the borderless and pseudonymous nature of blockchain transactions, requiring robust security measures and regulatory oversight.

Role of Blockchain in Digital Ownership

Blockchain generation performs a important position in permitting and safeguarding virtual ownership via offering a obvious, tamper-proof, and decentralized ledger. Through cryptographic techniques and consensus algorithms, blockchain networks make sure the integrity and immutability of digital property, facilitating peer-to-peer transactions.

Exploring the Use Cases of NFTs

NFTs have found applications in artwork, gaming, and tokenizing real-global belongings. They have revolutionized the art enterprise through supplying artists with new approaches to monetize their work and engage with a global audience. In gaming, NFTs allow players to very own and change in-game belongings, developing new monetization opportunities and participant-pushed economies.

Conclusion

Advancements in NFT and blockchain technologies have reshaped the digital possession panorama, supplying progressive answers for creators, creditors, and investors. From artwork to gaming to real-global assets, NFTs have the capability to revolutionize possession and switch mechanisms, democratizing get admission to to wealth and possibilities.

2 notes

·

View notes

Text

OpenAI’s GPT-4: The Future Of AI Or Potential Threat To Jobs?

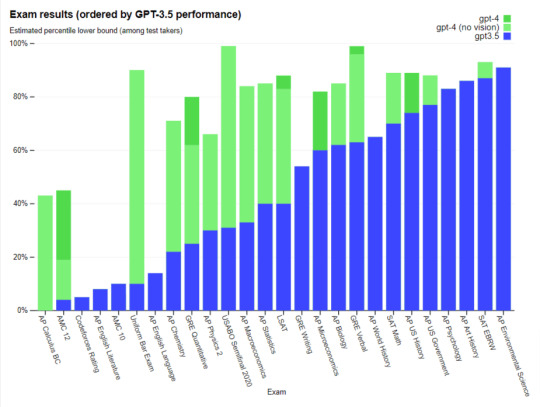

OpenAI, one of the leading companies in artificial intelligence, has recently announced the release of their latest model, GPT-4. This new model boasts impressive improvements, such as being able to process up to 25,000 words, understand images, and score high on exams designed to test knowledge and reasoning. GPT-4 is being used to power Microsoft’s Bing search engine platform, and Microsoft has invested a massive $10 billion into OpenAI. However, the model still faces significant challenges like other language models, including social biases, generating incorrect information, and exhibiting disturbing behaviors when given an “adversarial” prompt.

Key Highlights

Conor Grogan, a former director at Coinbase, claimed that he successfully embedded a live Ethereum smart contract into GPT-4 and quickly identified various “security vulnerabilities” in the code. He also explained how these vulnerabilities could be exploited.

OpenAI’s latest language model, GPT-4, offers impressive multilingual capabilities and can understand images.

GPT-4 can process up to 25,000 words and has a longer memory, but it still faces challenges like social biases and generating incorrect information.

Microsoft has invested $10 billion into OpenAI, and GPT-4 is already being used to power Bing search engine platform.

GPT-4 could potentially take over jobs currently done by humans, raising concerns about its impact on our economy.

As AI technology continues to advance, we need to ask questions about its impact on our society and ensure it is used ethically and with proper supervision.

Related: Tron and BitTorrent Team Up to Support AI Tool ChatGPT with New Payment System

Despite its limitations, GPT-4’s new capabilities could lead to new ways of exploiting it. As a generative AI, it uses algorithms and predictive text to create new content based on prompts. GPT-4 is less likely to be tricked and more stable than previous models, has a longer memory, and can remember up to 50 pages of text. Additionally, it is more multilingual and can answer thousands of multiple-choice questions in 26 languages with high accuracy. GPT-4 is a promising model that can describe images for visually impaired users through a partnership with Be My Eyes. Moreover, it can suggest an appropriate recipe if provided a photo of ingredients on a kitchen counter or explain the conclusions that can be drawn from a chart. However, there are concerns about it potentially taking over jobs currently done by humans.

It is essential to note that GPT-4 is initially only available to ChatGPT Plus subscribers who pay $20 per month for premium access. While this subscription model may seem prohibitive, it could offer an excellent opportunity for researchers and businesses to experiment with the model’s capabilities and understand its limitations.

In conclusion, GPT-4 is an impressive advancement in the field of artificial intelligence. Its multilingual capabilities, expanded token count, and longer memory offer substantial benefits. However, as with any AI model, it is not perfect and still faces significant challenges. We need to take precautions to ensure that it is used ethically and with proper supervision. As AI technology continues to advance, we must continue to ask questions about its impact on our society and our economy.

More Articles

Meta Platforms Inc. Discontinues NFT Support On Instagram And Facebook To Focus On Fintech

Square Enix Launches Symbiogenesis: A Groundbreaking NFT-Based Game With Narrative-Unlocked Entertainment

Ethereum Whale Sells 500 Moonbirds NFT, Suffers Significant Losses, And Causes Turbulence In NFT Market

Halborn Uncovers Critical Vulnerabilities In Dogecoin, Litecoin, And Other Blockchain Networks

2 notes

·

View notes

Text

Understanding the Blockchain Ecosystem: A Digital Revolution

Blockchain technology has rapidly evolved from being the foundation of cryptocurrencies to a transformative force across various industries. At the heart of this innovation lies the blockchain ecosystem—a dynamic network of interconnected components that drive decentralization, security, and efficiency.

What is a Blockchain Ecosystem?

A blockchain ecosystem is a structured network comprising different participants, technologies, and protocols that work together to support blockchain operations. It includes:

Blockchain Networks: Platforms like Ethereum, Binance Smart Chain, and Solana that provide the infrastructure for decentralized applications (dApps).

Cryptocurrencies & Tokens: Digital assets that facilitate transactions, governance, and rewards within the ecosystem.

Smart Contracts: Self-executing agreements that automate processes without intermediaries.

Decentralized Applications (dApps): Applications running on blockchain networks, ranging from DeFi (Decentralized Finance) to NFT marketplaces.

Miners & Validators: Individuals or entities that validate transactions and maintain the blockchain’s security.

Wallets & Exchanges: Tools that enable users to store, manage, and trade digital assets.

Key Benefits of a Blockchain Ecosystem

Decentralization: Eliminates the need for central authorities, giving users more control over their data and transactions.

Transparency & Security: Blockchain’s immutable ledger ensures that transactions are traceable and resistant to fraud.

Efficiency & Automation: Smart contracts streamline processes, reducing costs and the need for intermediaries.

Interoperability: The growing adoption of cross-chain solutions enables seamless interaction between different blockchain networks.

Industries Leveraging Blockchain Ecosystems

Finance (DeFi): Smart contracts power lending, staking, and yield farming, revolutionizing traditional banking.

Supply Chain Management: Blockchain enhances transparency and traceability in global trade.

Healthcare: Securely stores patient records while ensuring data integrity.

Gaming & NFTs: Enables digital ownership and tokenized in-game assets.

The Future of the Blockchain Ecosystem

As blockchain technology continues to evolve, the ecosystem will expand with advancements like Layer 2 scaling solutions, AI integration, and quantum-resistant cryptography. Innovations in Decentralized Identity (DID) and Web3 will further empower users, making blockchain a cornerstone of the digital economy.

At CIFDAQ, we are committed to shaping the future of blockchain by providing secure, scalable, and innovative solutions. Stay ahead of the curve and explore the limitless potential of the blockchain ecosystem with us!

Would you like me to tailor this article further to match your website’s specific offerings?

0 notes

Text

What Are the Latest Trends in Crypto Influencer Marketing?

In the fast-paced world of cryptocurrency and blockchain technologies, the role of influencers has become more significant than ever before. Influencers in the crypto space help bridge the gap between traditional finance and the digital economy. They serve as key figures for educating the masses about the potential and benefits of crypto investments, new blockchain innovations, and decentralized finance (DeFi) solutions. As the crypto landscape continues to evolve, so does the marketing strategy behind it. One of the most effective ways to reach the growing crypto audience is through influencer marketing. Crypto influencers, with their dedicated and often highly engaged followers, offer an authentic connection that traditional marketing efforts can’t always match.

As the demand for crypto-related content skyrockets, influencer marketing is no longer just a supplementary tool for brands in the blockchain industry—it’s a must-have strategy. The landscape of crypto influencer marketing is changing rapidly, driven by innovations in blockchain, NFT hype, and the decentralization of social media platforms. Understanding the latest trends in crypto influencer marketing is crucial for companies aiming to tap into the power of these digital tastemakers. In this blog, we will explore the top trends that are shaping the crypto influencer marketing landscape and how businesses can adapt to these changes to stay ahead of the curve.

The Rise of Crypto Influencer Marketing:

Influencers in the crypto space have emerged as powerful voices in an industry that thrives on trust and community. Whether through YouTube, Twitter, TikTok, or Telegram, crypto influencers are at the forefront of driving conversations around blockchain developments, new token launches, and DeFi protocols. Their reach often extends far beyond traditional advertising methods, allowing them to provide real-time insights and engage directly with their audiences.

As more people turn to social media for crypto education, influencer marketing continues to be a proven strategy to increase brand visibility. According to various studies, a significant percentage of crypto investors trust influencers more than traditional marketing sources. This rise in trust has made influencers invaluable to blockchain startups, exchanges, and companies looking to raise awareness about their products and services.

What Are the Latest Trends in Crypto Influencer Marketing?

Trend 1: Micro-Influencers Gaining Traction

While major crypto influencers with millions of followers still dominate the space, micro-influencers are becoming increasingly popular. These influencers often have fewer followers but a more engaged and loyal audience. The advantage of working with micro-influencers is that they can deliver highly targeted content, often resulting in better conversion rates and increased trust from their audience. Brands in the crypto sector are beginning to recognize that micro-influencers can offer a higher return on investment (ROI) compared to larger influencers with broader reach but less specific targeting.

Trend 2: Integration with Decentralized Platforms

With the decentralization of social media gaining momentum, crypto influencers are increasingly turning to platforms that align with the ethos of blockchain—decentralization and privacy. These platforms, such as Steemit, Publish0x, and others, offer users a more direct, transparent way to monetize content without relying on traditional, centralized social media giants like Instagram or YouTube. As crypto communities embrace these decentralized alternatives, influencer marketing within these ecosystems is becoming a powerful strategy.

Trend 3: Collaborations with NFT Projects

The surge in NFTs (non-fungible tokens) has given rise to a new form of influencer marketing. Crypto influencers are partnering with NFT creators and platforms to promote new collections, digital artwork, and exclusive drops. These collaborations are often mutually beneficial, as influencers gain access to unique NFT products, while NFT creators can leverage the influencer's reach to build hype around their collections. Given the rising interest in NFTs, this trend is expected to grow even more in the coming months.

Trend 4: Paid Partnerships with a Purpose

As cryptocurrency and blockchain technologies continue to mature, consumers are demanding more transparency from both brands and influencers. In response, crypto influencers are moving toward more transparent and ethical paid partnerships, focusing on projects that align with their values and the needs of their audience. Sponsored content that clearly discloses partnerships and demonstrates how the crypto product or service benefits the community is becoming the norm.

Trend 5: Long-term Brand Ambassadorships

Instead of short-term collaborations or one-off promotional posts, brands are increasingly opting for long-term relationships with crypto influencers. By signing brand ambassadorship deals, influencers can promote a product or service over time, building trust and loyalty among their followers. Long-term collaborations allow influencers to establish an authentic connection with the brand, while brands benefit from consistent exposure in front of an engaged audience.

What Are Crypto Influencers Looking For in Partnerships?

Crypto influencers are becoming more selective about the partnerships they engage in. They prioritize authenticity, transparency, and relevance. In the highly competitive crypto space, influencers need to maintain their credibility to stay trusted by their followers. As such, they tend to choose brands that align with their values and resonate with their audience’s interests. Additionally, influencers are drawn to projects that incorporate blockchain-based features, allowing them to participate in the decentralized revolution themselves.

How Do Crypto Influencers Impact Marketing ROI?

Measuring the effectiveness of influencer marketing campaigns is essential for ensuring the return on investment (ROI). For crypto projects, ROI from influencer partnerships can be measured through engagement rates, lead generation, and overall community growth. Since the crypto audience tends to be tech-savvy and eager to learn about new projects, influencer marketing often leads to higher engagement and greater conversion rates than traditional digital marketing methods.

How Do Blockchain Technologies Affect Influencer Marketing?

Blockchain technology is transforming the way influencer marketing is done by providing transparency in paid partnerships. With smart contracts, blockchain can track content distribution and ensure that influencers are fairly compensated for their contributions. Additionally, blockchain technology can help prevent fraud and promote trust in the influencer-marketing ecosystem, making it a perfect fit for the crypto space.

Conclusion:

Crypto influencer marketing continues to evolve, with trends shifting toward micro-influencers, decentralized platforms, and long-term partnerships. Staying on top of these trends is crucial for brands in the crypto industry looking to succeed in a rapidly changing market. By aligning with ethical influencers and leveraging blockchain technology, companies can ensure their marketing efforts remain effective and transparent, driving long-term growth and success.

#ai generated#ai#blockchain#crypto#cryptocurrency#crypto influencer marketing#blockchain app factory

0 notes

Text

Your Blockchain Journey Starts Here: Learn with Probinar

Introduction

In today’s rapidly evolving digital landscape, blockchain technology stands out as one of the most transformative innovations. It has already revolutionized industries like finance, healthcare, supply chain management, and even entertainment. Blockchain’s decentralized and secure structure not only offers transparency but also paves the way for innovations such as cryptocurrencies and non-fungible tokens (NFTs). If you’re eager to be part of this tech-driven revolution, Probinar’s online blockchain courses are the perfect starting point. With live classes and NFT certifications, you can gain the skills needed to excel in this dynamic field.

Why Should You Learn Blockchain Technology?

Blockchain technology is not just a buzzword; it’s the foundation of the digital economy. Here are some key reasons why learning blockchain is essential:

High Demand for Blockchain ExpertsCompanies across industries are seeking professionals with blockchain expertise. With job roles like blockchain developer, blockchain architect, and blockchain consultant on the rise, this skill is highly marketable.

Industry-Wide ApplicationsBeyond cryptocurrencies, blockchain is transforming sectors such as healthcare (for secure patient records), supply chain (for transparent tracking), and finance (for efficient transactions).

Future-Proof Your CareerAs the adoption of blockchain grows, professionals skilled in this technology will remain relevant and in demand for years to come.

What Makes Probinar’s Blockchain Courses Stand Out?

When it comes to learning blockchain technology, Probinar offers a comprehensive and practical approach that sets it apart from other platforms. Here’s what makes our courses unique:

Live Interactive Classes Unlike pre-recorded sessions, Probinar’s live classes provide an engaging learning experience. You can interact directly with industry experts, ask questions in real time, and gain clarity on complex topics.

Hands-On Projects Understanding blockchain concepts is just the beginning. With Probinar, you’ll work on real-world projects to implement what you learn. From creating smart contracts to exploring NFT development, our projects are designed to give you practical experience.

NFT-Based Certification At Probinar, we believe in staying ahead of the curve. Upon course completion, you’ll receive an NFT-based certificate—a digital credential that’s secure, verifiable, and a testament to your expertise.

Expert Mentors Our courses are led by seasoned blockchain professionals with extensive industry experience. Learn directly from the experts who understand the latest trends and best practices.

Flexible Learning Whether you’re a working professional or a student, Probinar’s flexible schedules ensure that you can learn at your own pace without disrupting your routine.

Who Can Benefit from Probinar’s Blockchain Courses?

Our courses are designed to cater to a diverse audience:

Beginners: If you’re new to blockchain, our courses provide a solid foundation to get you started.

Developers: Software engineers can learn how to create smart contracts, build decentralized apps (DApps), and more.

Business Professionals: Understand how blockchain can optimize operations and drive innovation in your industry.

Entrepreneurs: Learn how to leverage blockchain to create new business models and opportunities.

Key Features of Probinar’s Blockchain Courses

Comprehensive Curriculum: Covering topics like blockchain fundamentals, smart contracts, cryptocurrency, and NFT development.

Interactive Tools: Access to simulations, coding platforms, and blockchain networks for hands-on practice.

Community Support: Join a network of learners and professionals for collaboration and peer learning.

Career Assistance: Guidance on building a blockchain portfolio and acing interviews for blockchain-related roles.

Conclusion

Blockchain technology is reshaping the world, and there’s no better time to gain expertise in this field. Probinar’s online blockchain courses offer a perfect blend of theory, practice, and certification to help you stay ahead in your career. Whether you want to become a blockchain developer, start your own blockchain-based venture, or simply understand how this technology works, Probinar provides the tools and knowledge to succeed.

Take the leap into the future of technology. Enroll in Probinar’s blockchain courses today and unlock your potential with NFT-certified expertise!

0 notes

Text

Mastering the Basics: Cryptocurrency, Blockchain Technology, and NFT Investments

The entire economic world is shifting, and it isn’t any new information that cryptocurrencies, blockchain, and NFTs are at the center of this transformation. Simply put, these terms continue to gain popularity for the right reasons. You can now redefine everything, including money, ownership, and investments. “Imagine a future,” said an anonymous visionary. As every step in the purchase process continues to become digitized, intermediaries are slowly becoming a relic from the past. This trio is simply the start to a powerful future: cryptocurrency, blockchain, and NFTs.

With the increase in the number of systems designed around Bitcoin and cryptocurrency, decentralized networks continue to expand. This, however, raises several questions: Is cryptocurrency real? Does it possess any real value? It is becoming clear that it is only a matter of time before it escapes the borders of technology focused communities, reshapes the economy, and becomes one of the very first alternatives to fiat currencies. Bitcoin, for instance, is the embodiment of all this evolution. Never has it been possible for someone to control the transaction of someone else so conveniently as we exist in today’s world. Simply put, bitcoin and all cryptocurrencies is the solution we have been searching for and are unaware of.

What drives the Digital Twin’s sophisticated infrastructure is nothing else but the blockchain technology which has been a buzzword across the globe for innovators and entrepreneurs alike. So, what is it exactly? Let’s try and understand it with an example. Imagine a digital ledger that has been made immutable and devoid of any form of manipulation. Its transactions are endorsed by a decentralized network of users instead of a single centralized authority. It powers cryptocurrencies such as Bitcoin but also provides the solution to transform entire sectors such as medicine, art, and the supply chain. Because blockchains do not require us to trust the intermediaries, they automatically become a technology that creates trust.

But wait, that’s not the end of the story. You have the NFTs – Non-Fungible Tokens. A new paradigm for the buying, selling, and holding of digital assets such as virtual artwork and limited edition items. NFTs use blockchain technology to provide a way of verifying their owners. Now for the investors, NFTs perform the role of more than mere assets – they encompass a variety of experiences, identities, and even memberships. The amalgamation of art with blockchain technology has indeed opened a Pandora’s box of creativity and commerce coming together. So, what opportunities has this transformed?

The Rise of Cryptocurrency

So cryptocurrency what is in its essence? A cryptocurrency is a type of currency that exists in its digital form and is protected by sophisticated computer-generated codes. It works independently of government-issued currencies, which means that there is no need for centralized authority like banks to regulate it. Because of this, there is complete financial independence leading to free moving transactions between nations.

What is Bitcoin?

In order to answer the question of what is bitcoin, it is vital to note that Bitcoin is the first coin ever to start this monetary network. Bitcoin (BTC) is one of the first coins of this Cryptocurrency revolution. The first edition of Bitcoin was initiated in 2009 by a trademarked Satoshi Nakamoto who wanted to release a currency that could be an alternative of fiat money. But bitcoin’s utility is not limited to just its use as a currency. Rather, it has become a way of combating dictatorial powers and hyperinflation.

How Does Bitcoin Work?

To truly grasp how Bitcoin works, imagine a network of computers spread across the globe. Each computer maintains a copy of a public ledger (the blockchain), recording every transaction ever made. Transactions are grouped into “blocks,” forming a continuous chain. This is where the term currency bloc or block currency comes into play. The process of validating transactions, called mining, ensures transparency and security without the need for a central authority.

Blockchain: The Backbone of Cryptocurrency

A lot of people are asking: what is blockchain, or more accurately, what is blockchain technology? Blockchain is the technology behind a digital ledger which keeps information in a secured way that is impossible to hack. Its decentralized nature means it is controlled by no singular entity, therefore it is completely transparent, and trustworthy.

Blockchain Definition

Blockchain can be explained relatively easily, just like a series of blocks, each one filled with data along with a timestamp and a link to the prior block through a cryptic connection. This structure ensures that information that is stored is unchangeable.

Differences Between Blockchain and Crypto

There is a common notion that blockchain into crypto is a block to a chain. Despite the fact that this analogy is not accurate. Crypto is just one of the many uses of blockchain, which is the underlying technology. Just picture blockchain as a base upon which a house, cryptocurrency, is constructed.

Blockchain and Crypto Integration

The combination of blockchain and crypto proves advantageous, giving birth to systems that were never possible before. Blockchain has expanded its use beyond financial transactions. It is now involved in supply chain, healthcare, and even in art with NFT changing the face of digital asset ownership.

NFTs: Redefining Ownership in the Digital Age

One of the most fascinating uses of blockchain technology is Non-Fungible Tokens, often called NFTs. They are unique digital assets such as pieces of art or virtual real estate. Each asset is verified through blockchain technology. While cryptocurrencies can be exchanged and traded, NFTs are unique in that there is no exact replica.

The Role of Blockchain in NFTs

Blockchain acts as a ledger for NFTs that no one single entity has the ability to modify. It chronicles the history of ownership. It is capable of answering the most valuable questions such as who holds digital assets and on what blockchain do they operate? This verification method guarantees genuineness and obstructs duplication, which is what makes NFTs revolutionary for digital trading.

Common Questions About Cryptocurrency and Blockchain

Where is the crypto name coming from?

The term “crypto” is derived from the word cryptography, which is the method in which digital information is protected. At the base of cryptocurrency and blockchain is cryptography, which helps secure and preserve the veracity of transactions.

What does Bitcoin look like?

One of the most common questions is what does Bitcoin look like? The answer is simple: it is entirely digital. This means it does not have physical form. For individuals asking what Bitcoin looks like, envision it as a string of encrypted code stashed inside a digital wallet. The wallet possesses a distinct address and allows the person to both send and receive bitcoins safely.

Crypto and Bitcoin Difference

Understanding the crypto and bitcoin difference is crucial. While Bitcoin is a specific cryptocurrency, the term “crypto” encompasses a wide range of digital currencies, including Ethereum, Litecoin, and newer entrants like Solana.

Building Your Own Cryptocurrency

For those interested in innovation, the question of how to make a cryptocurrency or how to make a crypto coin often arises. Creating a cryptocurrency involves developing a blockchain, defining the coin’s purpose, and ensuring security protocols. While it’s a complex process, open-source platforms like Ethereum make it more accessible.

Is Technology Used for Investing in Bitcoin?

Absolutely. Advanced analytics tools, trading algorithms, and secure digital wallets are examples of technology used for investing in Bitcoin. These tools empower investors to make informed decisions and safeguard their assets.

The Future of Blockchain and Cryptocurrency

Which One of the Statements Is True About Cryptocurrency?

The most accurate statement is that cryptocurrency is decentralized and operates without the need for a central authority. This decentralization is its most defining characteristic.

Which Crypto Has the Most Potential?

While Bitcoin remains the leader in market capitalization, newer cryptocurrencies like Ethereum, with its smart contract capabilities, and Solana, known for its speed and scalability, are gaining significant traction.

The Crypto Network and Lead-In Coins

The rise of the crypto network has introduced terms like crypto lead-in to coin, which refer to smaller, emerging cryptocurrencies that pave the way for new innovations in the blockchain space.

Investing in the Digital Economy

Why It Matters

The integration of blockchain into global systems signifies a shift toward transparency, security, and efficiency. Whether you’re looking to look into Bitcoin, explore the differences between blockchain and crypto, or invest in NFTs, the possibilities are vast.

Taking Action

The question isn’t just how to make cryptocurrency or how to make a crypto coin, but how to leverage this technology to build a better financial future. By understanding the basics and staying informed, you can become an active participant in this revolutionary ecosystem.

Mastering cryptocurrency, blockchain technology, and NFTs isn’t just about staying relevant; it’s about shaping your role in the digital economy. As these technologies evolve, so too will the opportunities they present. Will you be ready to seize them?

1 note

·

View note

Text

The Role of Blockchain and NFTs in Powering the Metavers

The metaverse is no longer just a futuristic concept; it is a burgeoning digital ecosystem reshaping how individuals, businesses, and communities interact. At the core of this digital revolution lies blockchain technology and non-fungible tokens (NFTs), which are integral to creating and sustaining a decentralized, interoperable, and immersive virtual world. For C-suite executives, startup entrepreneurs, and managers, understanding the role of blockchain and NFTs in powering the metaverse is key to unlocking its immense potential.

Blockchain: The Backbone of the Digtal Realm

Blockchain technology serves as the foundational infrastructure for the metaverse. Its decentralized nature ensures transparency, security, and trust—essential attributes for any digital ecosystem. By eliminating the need for intermediaries, blockchain enables direct peer-to-peer interactions, which are crucial for seamless transactions and interactions within the virtual universe.

Key Contributions of Blockchain:

Decentralization: Traditional platforms are often controlled by centralized entities, leading to concerns over data ownership and censorship. Blockchain decentralizes control, allowing users to retain ownership of their digital assets and data.

Interoperability: The metaverse consists of multiple platforms and virtual worlds. Blockchain enables these disparate ecosystems to interconnect, allowing users to move assets, identities, and experiences across different virtual universe platforms seamlessly.

Security and Transparency: Blockchain’s cryptographic principles ensure that all transactions and data exchanges within the realm are secure and immutable. This builds trust among users and businesses operating in virtual environments.

Smart Contracts: These self-executing contracts facilitate automated agreements between parties in the digital universe. From virtual real estate transactions to subscription services, smart contracts streamline processes and reduce administrative overhead.

NFTs: The Currency of Ownership

Non-fungible tokens (NFTs) have emerged as a transformative force within the metaverse, enabling true ownership of digital assets. Unlike cryptocurrencies, which are interchangeable, NFTs are unique and verifiable through blockchain. This uniqueness makes NFTs ideal for representing ownership of virtual goods, art, and even experiences in the digital realm.

How NFTs Enhance the Virtual Universe Experience?

Digital Ownership: NFTs empower users to own virtual assets such as virtual real estate, digital fashion, and in-game items. These assets can be bought, sold, or traded, creating a dynamic virtual economy.

Creator Empowerment: Artists, developers, and content creators can monetize their work directly through NFTs. This reduces reliance on intermediaries and allows creators to earn royalties every time their NFTs are resold.

Identity and Personalization: In the digital realm, NFTs can represent user identities, avatars, and customization options. This personalization fosters deeper engagement and a sense of individuality in virtual environments.

Interoperable Assets: NFTs enable users to transfer digital assets across different platforms and games within the metaverse, enhancing their utility and value.

Real-World Applications

The combination of blockchain and NFTs has already begun to transform industries and pave the way for virtual realm adoption.

Virtual Real Estate:

In the digital realm, users can purchase and own virtual land as NFTs. Platforms like Decentraland and The Sandbox have demonstrated how virtual real estate can be monetized through events, advertising, and resale. Blockchain ensures the authenticity and transferability of these virtual properties

Gaming:

Blockchain-based games like Axie Infinity and Gods Unchained use NFTs to give players ownership of in-game assets. This has revolutionized the gaming industry by creating “play-to-earn” models, where users can generate real income through gameplay.

Fashion and Retail:

Brands like Gucci and Nike are leveraging NFTs to sell digital fashion items in the metaverse. These virtual goods can be worn by avatars or displayed in virtual spaces, blending fashion with technology.

Events and Experiences:

Virtual concerts, conferences, and exhibitions are becoming popular in this digital realm. NFTs serve as tickets and provide access to exclusive content, creating new revenue streams for event organizers.

Challenges and Considerations

While blockchain and NFTs offer immense potential, they are not without challenges. Scalability remains a critical issue, as high transaction volumes can overwhelm blockchain networks. Environmental concerns related to energy-intensive proof-of-work blockchains also need to be addressed.

Additionally, the speculative nature of NFTs has led to volatility and market saturation. For the metaverse to thrive, businesses and developers must focus on creating genuine value and utility for NFTs rather than capitalizing solely on hype.

The Future of Blockchain and NFTs

As the metaverse continues to evolve, blockchain and NFTs will play an increasingly central role in shaping its infrastructure and economy. Innovations like layer-2 solutions, proof-of-stake blockchains, and decentralized autonomous organizations (DAOs) are expected to address current limitations and drive widespread adoption.

For businesses, this virtual universe offers unparalleled opportunities to engage with customers, foster collaboration, and create new revenue streams. By leveraging blockchain and NFTs strategically, companies can position themselves as pioneers in this transformative digital era.

Conclusion

The synergy between blockchain and NFTs is unlocking the full potential of the metaverse, creating a decentralized, secure, and immersive digital world. For C-suite executives, startup entrepreneurs, and managers, understanding these technologies is essential to staying ahead in an increasingly virtual economy. As the digital realm continues to expand, those who embrace blockchain and NFTs will be well-positioned to lead the next wave of digital innovation.

Uncover the latest trends and insights with our articles on Visionary Vogues

0 notes

Text

What Are the Key Services Offered by a Cryptocurrency Development Company?

Cryptocurrency has revolutionized the financial world, introducing a decentralized and secure way to conduct transactions globally. Businesses and individuals are increasingly recognizing the potential of blockchain and cryptocurrency technologies, leading to a growing demand for expert cryptocurrency development companies. These companies provide a range of services to help businesses create, launch, and manage their own cryptocurrencies and related solutions. Below, we delve into the key services offered by a cryptocurrency development company, detailing how they contribute to the ever-evolving digital economy.

1. Custom Cryptocurrency Development

One of the primary services offered by cryptocurrency development company is creating custom cryptocurrencies tailored to specific business needs. This involves:

Defining the Purpose: Understanding the client's objectives, whether it’s creating a utility token for a specific platform or a cryptocurrency aimed at facilitating global transactions.

Blockchain Selection: Identifying the most suitable blockchain platform, such as Ethereum, Binance Smart Chain, or custom-built blockchains.

Consensus Mechanism Implementation: Designing and implementing consensus protocols like Proof of Work (PoW), Proof of Stake (PoS), or Proof of Authority (PoA) to ensure network security and efficiency.

Token Standards: Developing tokens adhering to popular standards like ERC-20, BEP-20, or custom frameworks.

2. Blockchain Development

Blockchain is the foundation of any cryptocurrency. Cryptocurrency development companies often provide end-to-end blockchain development services, including:

Blockchain Architecture Design: Creating scalable, secure, and efficient architectures.

Smart Contracts Development: Writing and deploying self-executing contracts that automate processes on the blockchain.

Private and Public Blockchain Solutions: Building blockchain networks that cater to public or private use cases, depending on the business’s requirements.

Interoperability Solutions: Ensuring seamless integration and communication between different blockchain networks.

3. Token Development Services

Tokens play a vital role in the cryptocurrency ecosystem, representing assets, utilities, or securities. Key aspects of token development services include:

Utility Tokens: Creating tokens that grant users access to a product or service within a specific ecosystem.

Security Tokens: Developing compliant tokens backed by tangible assets, like real estate or stocks.

Non-Fungible Tokens (NFTs): Designing unique digital assets for use in industries such as gaming, art, and real estate.

Token Minting and Burning Mechanisms: Implementing systems to regulate token supply and demand.

4. Wallet Development

Cryptocurrency wallets are essential for storing, sending, and receiving digital assets. Cryptocurrency development companies offer wallet development services, including:

Multi-Currency Wallets: Developing wallets that support multiple cryptocurrencies, ensuring convenience for users.

Cold and Hot Wallets: Building secure cold wallets for offline storage and hot wallets for frequent transactions.

Mobile and Web Wallets: Creating user-friendly wallets compatible with mobile devices and web browsers.

Security Features: Incorporating advanced features like multi-signature authentication, biometric access, and end-to-end encryption.

5. Exchange Development

Cryptocurrency exchanges are platforms where users can trade digital assets. Development companies provide:

Centralized Exchanges: Creating platforms with a single authority overseeing transactions.

Decentralized Exchanges (DEXs): Developing peer-to-peer trading platforms powered by smart contracts.

Hybrid Exchanges: Combining features of both centralized and decentralized platforms for enhanced user experience.

Liquidity Solutions: Implementing tools to ensure sufficient liquidity for smooth trading operations.

Security Features: Integrating anti-fraud mechanisms, two-factor authentication, and other safeguards.

6. Smart Contract Development and Auditing

Smart contracts are at the core of decentralized systems. Cryptocurrency development companies specialize in:

Design and Deployment: Writing smart contracts for various use cases, including DeFi, NFTs, and supply chain solutions.

Auditing Services: Performing rigorous testing to identify vulnerabilities and ensure the security and reliability of smart contracts.

Optimization: Enhancing the efficiency of smart contracts by reducing gas fees and improving execution speed.

7. DeFi Development

Decentralized Finance (DeFi) is reshaping traditional financial systems. Cryptocurrency development companies provide services to build DeFi applications, such as:

Lending and Borrowing Platforms: Enabling peer-to-peer lending and borrowing of digital assets.

Yield Farming and Staking: Creating systems for users to earn rewards by providing liquidity or staking tokens.

Decentralized Exchanges: Developing platforms for secure and transparent trading.

DeFi Wallets: Building wallets that seamlessly integrate with DeFi platforms.

8. Initial Coin Offering (ICO) and Token Sale Platforms

Fundraising is a critical aspect of launching a cryptocurrency project. Development companies assist with:

ICO Development: Building platforms for launching and managing initial coin offerings.

Token Sale Platforms: Creating secure and scalable platforms for pre-sales, private sales, and public token sales.

Whitepaper Creation: Developing detailed project documents outlining technical and financial aspects to attract investors.

Marketing Support: Providing promotional strategies to ensure successful fundraising campaigns.

9. Cryptocurrency Payment Gateway Development

Enabling businesses to accept cryptocurrency payments is another vital service. This includes:

Integration Services: Integrating payment gateways into existing platforms.

Multi-Currency Support: Allowing businesses to accept various cryptocurrencies.

Real-Time Conversion: Implementing features to convert cryptocurrencies into fiat currencies instantly.

Security Features: Adding encryption, fraud detection, and compliance with global regulations.

10. Enterprise Blockchain Solutions

Cryptocurrency development companies cater to enterprises looking to integrate blockchain solutions into their operations. These solutions include:

Supply Chain Management: Enhancing transparency and traceability.

Identity Management: Developing secure systems for digital identities.

Data Management: Creating tamper-proof systems for storing and sharing data.

Cross-Border Payments: Streamlining international transactions with blockchain technology.

11. Maintenance and Support

Post-development support is essential for the success of any cryptocurrency project. Key services include:

Regular Updates: Ensuring compatibility with new blockchain protocols and security standards.

Bug Fixes: Addressing issues promptly to maintain seamless operations.

Performance Monitoring: Continuously analyzing the system’s performance to identify and resolve bottlenecks.

Technical Support: Offering 24/7 assistance to resolve any challenges faced by users.

Conclusion

Cryptocurrency development companies play a pivotal role in the digital transformation of businesses. By offering a wide array of services, including custom cryptocurrency creation, blockchain development, wallet development, and DeFi solutions, they empower businesses to harness the full potential of blockchain and cryptocurrency technologies. Whether you are a startup looking to launch your first token or an enterprise seeking to integrate blockchain into your operations, partnering with a reliable cryptocurrency development company is the key to success in this rapidly evolving industry.

0 notes

Text

Web3 Gaming: Future and How to Get Involved

Introduction to Web3 Gaming Web3 gaming is revolutionizing the gaming industry by integrating blockchain technology, enabling players to have ownership of in-game assets, trade them freely, and participate in decentralized economies. Unlike traditional games, Web3 games offer new opportunities for monetization, gameplay mechanics, and player engagement through cryptocurrencies and NFTs.

The Future of Web3 Games As blockchain technology continues to evolve, Web3 games are expected to become more immersive, with enhanced player-driven ecosystems. The future promises more decentralized platforms, player governance, and cross-game asset interoperability. The rise of play-to-earn mechanics, where players can earn real-world value by playing games, is a significant trend, attracting a growing user base.

How to Play Web3 Games To get started with how to play Web3 games, you need to understand the basics of blockchain, cryptocurrencies, and NFTs. First, create a digital wallet compatible with Web3 games. Then, explore gaming platforms that offer blockchain-based games. From there, you can buy in-game assets or participate in game economies using tokens and NFTs. Always research the game’s ecosystem before getting involved to ensure a safe experience.

How to Get Involved in Web3 Game Development If you're interested in the development side, consider collaborating with a Web3 game development company to create your own blockchain-based game. Understanding the technical aspects of smart contracts, NFTs, and decentralized finance (DeFi) will help you build engaging and innovative Web3 games.

0 notes

Text

[ad_1] Metamask obtain tumblr serves as your gateway to decentralized finance (DeFi) and non-fungible tokens (NFTs), all whereas conserving issues user-friendly and accessible. Whether or not you’re an skilled crypto fanatic or simply dipping your toes into blockchain waters, understanding methods to make the most of Metamask on Tumblr can open up new avenues for engagement, creativity, and transactions. What's Crypto and Why is it Vital? Crypto, quick for cryptocurrency, represents a revolutionary digital foreign money that operates on blockchain know-how. In contrast to conventional currencies issued by governments, cryptocurrencies are decentralized and maintained by networks of computer systems across the globe. This decentralization brings transparency and safety to monetary transactions. Every transaction is recorded in an immutable ledger, making fraud practically not possible. Cryptocurrency additionally empowers people with higher management over their funds. With crypto, customers can ship cash throughout borders with out counting on banks or intermediaries. This opens doorways for individuals who lack entry to traditional banking programs. Moreover, the rise of crypto has spurred innovation in varied sectors like artwork by NFTs and finance by way of DeFi platforms. It encourages new enterprise fashions that problem conventional practices whereas selling inclusivity inside economies worldwide. Understanding crypto’s significance right now means greedy its potential to reshape how we take into consideration cash and worth change in our more and more digital world. Understanding Metamask and its Advantages on Tumblr MetaMask is a strong digital pockets that bridges the hole between conventional on-line experiences and the world of cryptocurrency. It permits customers to handle their crypto property seamlessly whereas searching websites like Tumblr. On Tumblr, MetaMask opens doorways to decentralized purposes and NFT marketplaces. Customers can discover distinctive content material, commerce digital artwork, and even tip creators straight by blockchain transactions. The mixing enhances person engagement by permitting for safe interactions with out compromising privateness. With its intuitive interface, each newcomers and seasoned crypto fanatics can navigate with ease. Furthermore, MetaMask helps varied cryptocurrencies, making it versatile for several types of transactions on Tumblr’s vibrant platform. As extra artists and creators embrace blockchain know-how, having MetaMask at your fingertips turns into more and more important for taking part on this new digital financial system. Step by Step Information on The best way to Obtain Metamask on Tumblr Downloading Metamask on Tumblr is an easy course of. Begin by opening your most well-liked net browser. Go to the official Metamask web site to make sure you’re getting the real extension. There, search for the obtain choice tailor-made in your browser—be it Chrome, Firefox, or one other supported platform. When you’ve clicked on the suitable hyperlink, observe the prompts so as to add the extension to your browser. Set up usually takes only a few moments. After set up, you’ll see the Metamask icon seem in your extensions bar. Click on it to start establishing your pockets. The setup will information you thru creating an account or restoring an present one if wanted. With every little thing arrange appropriately, you’re now able to discover cryptocurrency transactions straight from Tumblr! The best way to Use Metamask for Cryptocurrency Transactions on Tumblr Utilizing Metamask on Tumblr for cryptocurrency transactions is easy. First, be sure to have the extension put in and arrange your pockets with some funds. When searching by posts or interacting with creators who settle for crypto, search for cost choices that contain Ethereum or different supported tokens. This typically comes within the type of a QR code or an tackle hyperlink. To ship funds, click on o

n the Metamask icon in your browser. Enter the recipient’s pockets tackle and specify how a lot you need to ship. Don’t neglect to verify transaction charges earlier than confirming. For receiving funds, merely share your pockets tackle with others. You possibly can even create a singular hyperlink that directs followers straight to your pockets for straightforward contributions. Keep alert for any notifications from Metamask about pending transactions. It retains every little thing safe whereas offering real-time updates as transactions are processed. The Way forward for Crypto and Social Media Platforms The intersection of cryptocurrency and social media is brimming with potential. As digital currencies acquire traction, platforms like Tumblr are exploring progressive methods to combine them into their ecosystems. Think about a world the place creators monetize their content material by crypto transactions. Followers may straight help artists by tipping in cryptocurrencies, making a seamless connection between worth and engagement. Moreover, decentralized platforms could emerge, permitting customers higher management over their information and privateness. This shift may empower people whereas disrupting conventional promoting fashions reliant on private info. Social media can facilitate community-driven initiatives funded by crypto donations. Customers could collaborate on initiatives that resonate with shared values, fostering deeper connections inside on-line communities. As know-how evolves alongside person expectations, the longer term guarantees an thrilling panorama for each crypto fanatics and social media customers alike. The synergy between these worlds holds great potentialities ready to be explored. Conclusion: As we step right into a world more and more intertwined with digital currencies, understanding instruments like Metamask can improve your on-line expertise. The fusion of crypto and social media presents infinite potentialities. Partaking with Tumblr whereas utilizing Metamask opens doorways to new communities anticipating progressive exchanges. This dynamic mix encourages creativity and expands horizons. Embracing this know-how isn’t nearly transactions; it’s about being half of a bigger motion. Customers can discover decentralized finance (DeFi) and different blockchain improvements seamlessly by their favourite platform. FAQ’s What's Metamask? Metamask is a well-liked crypto pockets and gateway to blockchain apps. It permits customers to handle their Ethereum-based property seamlessly. Can I take advantage of Metamask on my cellular system? Sure, Metamask presents a cellular app out there for each iOS and Android units. You possibly can obtain it straight from the App Retailer or Google Play. Is it secure to make use of Metamask? Whereas no platform can assure absolute safety, utilizing sturdy passwords, enabling two-factor authentication, and working towards good on-line security habits will considerably improve your safety when utilizing Metamask. The submit Unlocking the Energy of Crypto on Tumblr: Your metamask obtain tumblr appeared first on Vamonde. [ad_2] Supply hyperlink

0 notes

Text

Investment Comparison: Stocks vs. Gold vs. Cryptocurrency

Investing has always been the cornerstone of financial growth, and as the global economy evolves, investors are faced with various options. Among these, stocks, gold, and cryptocurrency stand out as primary choices, each with unique characteristics, risks, and potential returns. Understanding the differences between them can help investors make informed decisions, especially when considering future-oriented investments like Vyxia Token.

Stocks: Building Traditional Wealth

Stocks represent ownership in a company, offering investors the opportunity to benefit from the company’s growth and profitability. Key advantages include:

Growth Potential: Stocks have historically provided significant returns over the long term, often outperforming other asset classes.

Liquidity: Stocks are easily bought and sold on exchanges, making them highly liquid.

Income Through Dividends: Many stocks pay dividends, providing a steady income stream.

However, stocks are subject to market volatility, economic conditions, and company-specific risks, making them a higher-risk investment compared to some alternatives.

Gold: A Safe Haven Asset

Gold has been a symbol of wealth and a reliable store of value for centuries. It is often viewed as a safe haven during economic uncertainty. Key benefits include:

Stability: Gold prices tend to be less volatile than stocks and are often negatively correlated with the stock market.

Inflation Hedge: Gold preserves purchasing power over time, making it an effective hedge against inflation.

Tangible Asset: As a physical commodity, gold is not dependent on the performance of any institution.